How Music Audits Uncover Hidden Revenue:

So… we ran three YouTube audits. Guess what happened?

Interesting what patterns start to repeat when you audit more than one catalog…

It usually starts with a single question. An artist, a manager, or an estate wondering why the streaming numbers don’t quite match the royalties. Why YouTube shows millions of views, yet there’s barely a trace of it in the financial statements. Or why one specific platform keeps showing up as a blank space in the ledger - year after year.

What looks like a one-off case at first… quickly becomes a recurring pattern.

Because once you audit more than one catalog, you start to realize: we’re not dealing with isolated errors. We’re dealing with a system.

Structural repetition over individual exceptions

The first audit often comes with hope. Maybe it’s a licensing oversight. Maybe a forgotten sync, a misassigned territory, a missing channel link. But the more catalogs you examine, the clearer it becomes: this is not an accident.

The same anomalies appear across statements - across genres, countries, rights holders, and timeframes:

YouTube income that never gets reported on a per-track basis.

Label pools that absorb individual stream performance into a generalized share.

VEVO revenue streams quietly left out - often behind vague references to “confidentiality.”

Platform splits that remain suspiciously consistent, regardless of actual traffic or territory shifts.

Retroactive “adjustments” that somehow always benefit the distributor - rarely the artist.

And once you begin to see identical language in different agreements, the question is no longer if there's a system behind it. The only question is how deep it goes.

What happens when you apply the same methodology more than once?

Scalability changes everything. Not just the volume of insights - but their credibility.

A one-off dispute can be denied. An odd-looking royalty line explained away. A single correction framed as goodwill.

But what happens when you apply the same audit approach to five, ten, or twenty catalogs - with near-identical results?

At that point, it’s no longer about suspicion. It’s about evidence.

The power of comparability

What used to be impossible - validating YouTube-based royalties at the CPM level, reconstructing geo distributions, cross-referencing internal statements against real-world performance - is now technically doable. Not through guesswork. But through systematized API logic, public benchmarks, and mathematically verifiable models.

Once you apply the same methodology across multiple catalogs, you gain a frame of reference that transcends the individual case.

Anomalies are no longer relative. They become relational:

Why does Catalog A show the same 40% revenue gap as Catalog B despite different genres and geographies?

Why are key markets underrepresented across multiple artist reports?

Why does no label pool distribution ever align with publicly visible viewership rankings?

We’ve built our own internal infrastructure to make this possible. For years, it was just our secret weapon. Soon, every artist, manager, and accountant will have it at their fingertips.

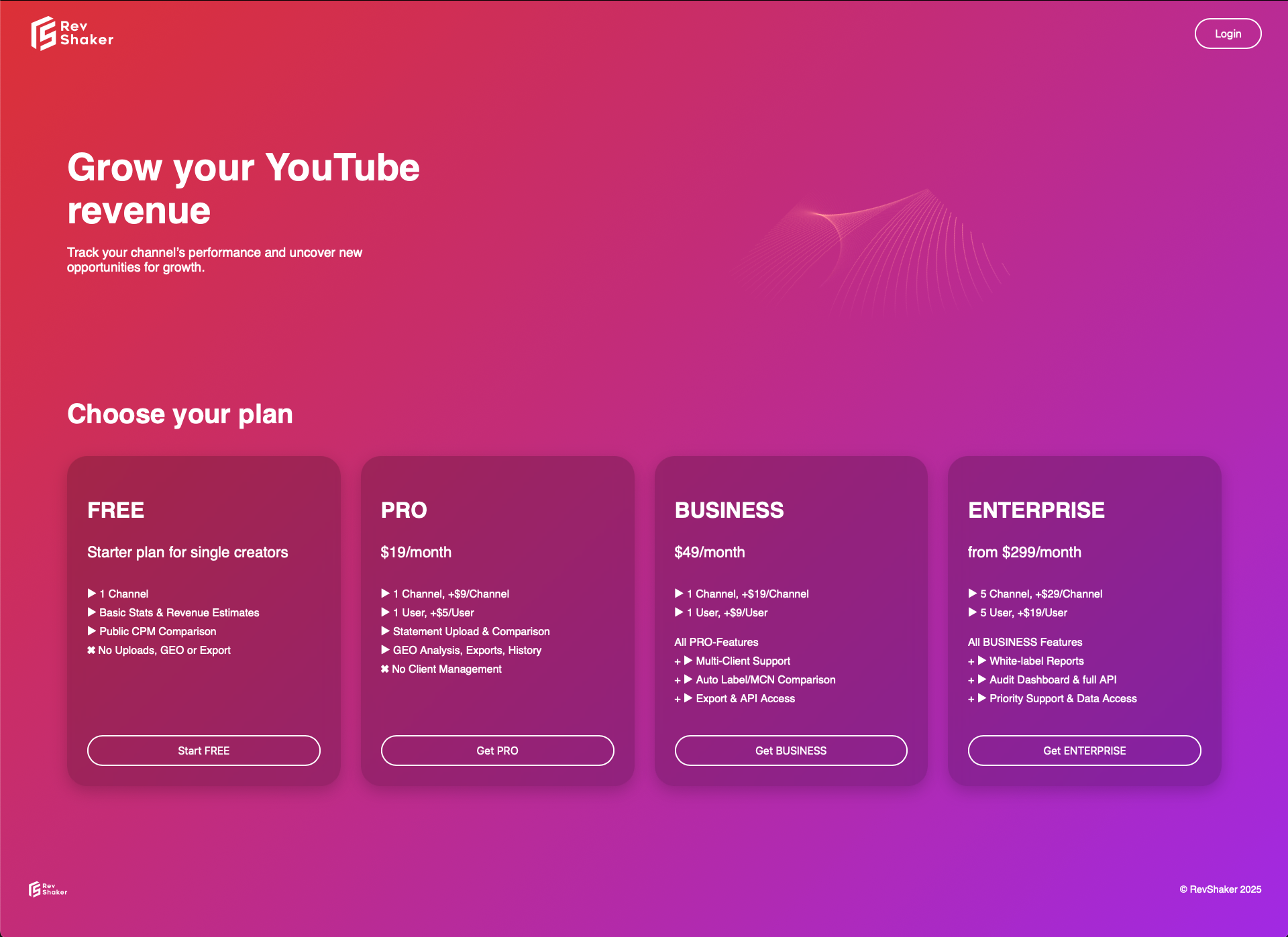

RevShaker - our custom audit engine - tracks channel data daily, stores long-term trends, and cross-analyzes viewership with revenue expectations. Combined with our GEO detection system, we map country-specific audience data to real advertising rates - using CPM benchmarks down to the territory and device level. All of this sits on a growing historical database that captures channel evolution over time.

And behind it, a machine learning layer continuously refines territorial revenue attribution based on language, user behavior, and content signals. Not just for one artist. For any artist.

These are no longer rhetorical questions. They’re data-backed.

That’s why our audits don’t depend on luck. They depend on math.

The narrative flips

What can be explained away for one artist becomes indefensible when repeated.

Especially when internal justifications begin to fall apart:

“We don’t have access to VEVO data.”

→ Even though the label co-founded VEVO, still owns a stake, and consolidates its revenues on their balance sheets.“YouTube is pooled and paid out proportionally.”

→ But actual CPM data - segmented by device, geography, and placement - shows a vastly different revenue footprint.“Everything is accounted for.”

→ Until a third-party audit recalculates the data and uncovers seven figures of missing revenue.

Once the audit process becomes standardized, scalable, and precise, the burden of proof quietly shifts.

Scale as leverage, not liability

Many rights holders hesitate to initiate audits. Out of fear it may backfire. Out of concerns it’s too much effort for too little gain.

But what hasn’t paid off in the past is not auditing - or auditing without structure.

Because the real value of an audit isn’t in the isolated outcome. It’s in its replicability.

Every additional catalog strengthens the statistical case. Every repeated discrepancy builds legal credibility. Every audit that follows the same logic increases pressure on a system that’s survived on opacity and fragmentation.

We’re not done

Three audits. Three matching patterns. Three structurally flawed systems exposed - without shouting, without threats, but with precision.

What still looks like an isolated anomaly today will soon become a standard blueprint. For stronger contracts. For transparent reporting. For meaningful accountability in the YouTube-Music-Age.